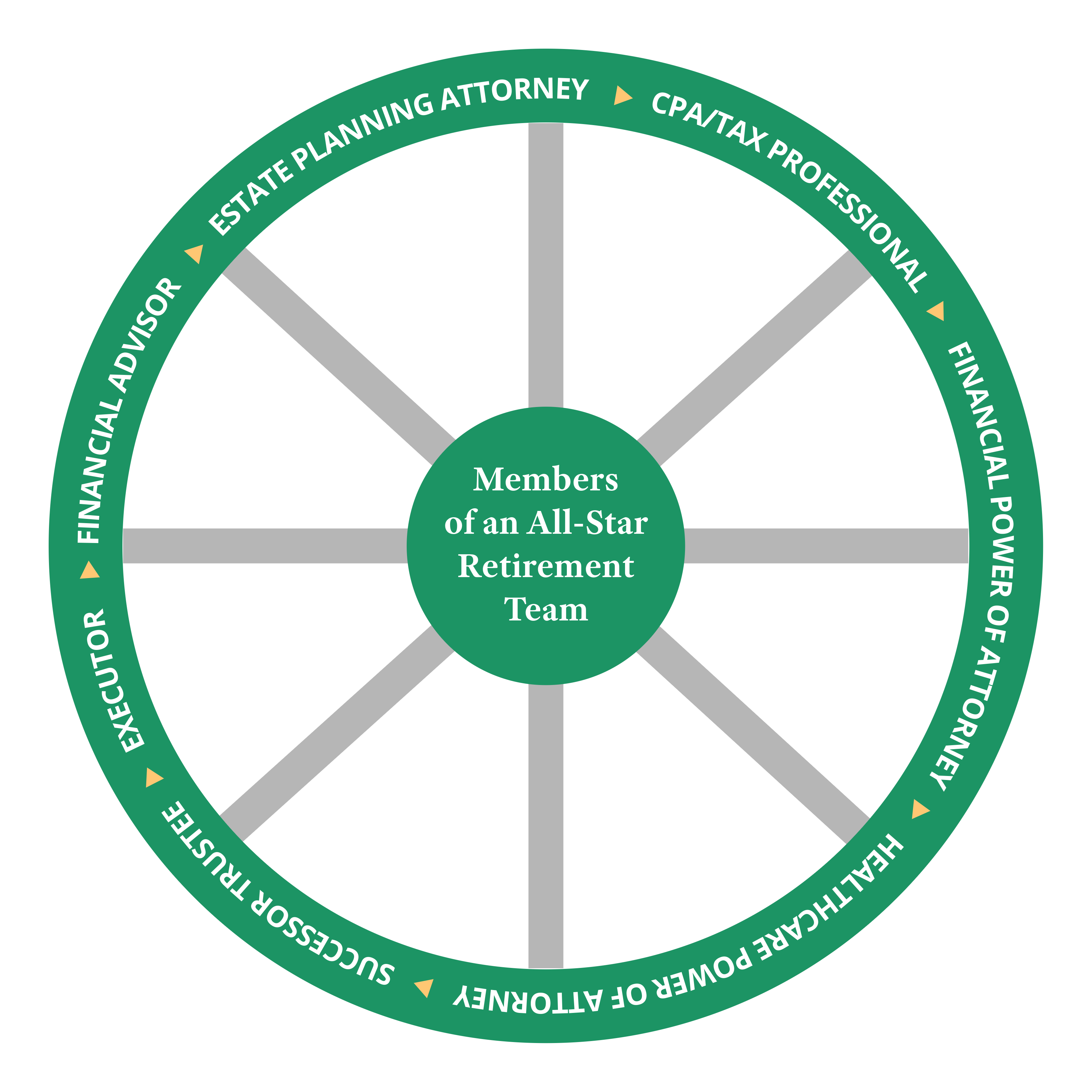

A successful retirement is not just about saving enough money; it is also about assembling a trusted team of professionals who will look out for your best interests now, throughout retirement, and beyond. Having the right people in place provides peace of mind and ensures your financial and legal affairs are managed properly and according to your wishes.

KEY PLAYERS IN YOUR RETIREMENT PLAN

Financial Advisor

The first step in creating a solid retirement plan is finding a qualified financial advisor. This professional will serve as the coordinator of your plan and help you bring together the right team members. Your financial advisor can review your financial statements, identify goals, address questions, and build and monitor your plan.

Look for an advisor who understands your goals, priorities, and values, and acts as a fiduciary, meaning they are legally required to put your best interests first, offering advice that’s in your best interest, not based on commissions. Start your search by asking trusted friends or family members for recommendations, then interview potential advisors to ensure a good fit.

You will also want to consider costs and fees. Financial planning costs vary based on location and services. Some advisors charge $150 or more per hour, while others work on a percentage basis, typically 0.5% to 1.5% of assets under management. Make sure to ask about fees upfront when you’re interviewing potential planners.

Estate Planning Attorney

Getting your affairs in order involves setting up a comprehensive estate plan that ensures your wishes are carried out and your assets are distributed according to your preferences. That includes preparing the following documents:

- Revocable Trust (in most cases),

- Will,

- Financial Power of Attorney and

- Health Care Power of Attorney.

Estate laws vary by state, so it’s essential to work with an experienced estate planning attorney to prepare or review your plan and documents. They can guide you on the best legal tools for your specific needs and explain how to use wills, trusts, powers of attorney, and other legal documents to your advantage. An estate planning attorney can also help uncover potential concerns you may not have considered.

Tax Professional

Tax planning plays a crucial role in managing your retirement finances. Licensed tax professionals include Certified Public Accountants (CPAs), Enrolled Agents (EAs), and Tax Attorneys.

Since tax laws vary by state, working with a local expert is best. Tax planning involves looking at your financial plan, portfolio, and overall situation from a tax perspective—ideally, on a year-round basis. The purpose is to help you avoid unnecessary taxes—so you can keep more of your earnings. Having a qualified tax professional on your team will help you get all the deductions and credits you qualify for and avoid costly filing mistakes. Working alongside your financial advisor, your CPA or a tax professional can help you make informed, tax-efficient decisions to protect your wealth.

Successor Trustee

A successor trustee is responsible for managing and settling your estate according to the legal provisions outlined in the trust after you pass away. Serving as a trustee requires expertise in financial management, legal compliance, and fiduciary duties. Mistakes or mismanagement can have serious consequences for the trust and its beneficiaries.

While some people initially name an individual to serve as trustee, they often name a corporate trustee as a successor due to the significant responsibilities involved. A corporate trustee, such as Covenant Trust, brings the necessary experience to navigate complex laws and efficiently administer the trust according to your wishes. Ultimately, selecting a trustworthy and experienced trustee provides peace of mind, ensures your estate is managed properly, and relieves your loved ones of the burden of administration.

Executor

Your will is a legally binding document that outlines your wishes for how your property—excluding assets held in a trust—should be distributed. The executor’s job is to administer the estate and carry out those wishes. Choosing who will be your executor [aka, personal representative] is one of the most important decisions you will make. The executor has significant responsibilities, some of which may be difficult or confusing, and may have 1-2 years of work that carries legal liability and the risk of unpopularity with beneficiaries. For these reasons, you should give careful thought to your choice of executor.

Factors to Consider When Choosing an Executor:

- Trustworthiness – Do you trust this person to handle your estate responsibly?

- Capability – Can they manage financial, legal, and tax-related matters?

- Impartiality – Will they remain fair and neutral in potential family disputes?

- Longevity – Are they likely to outlive you by at least five years?

- Proximity – Do they live close enough to manage duties efficiently?

- Willingness – Are they willing to take on the responsibility?

- Understanding – Do they grasp the requirements of the role?

- Successor Executor – You should name a successor executor in case your first choice is unable or unwilling to serve or predeceases you.

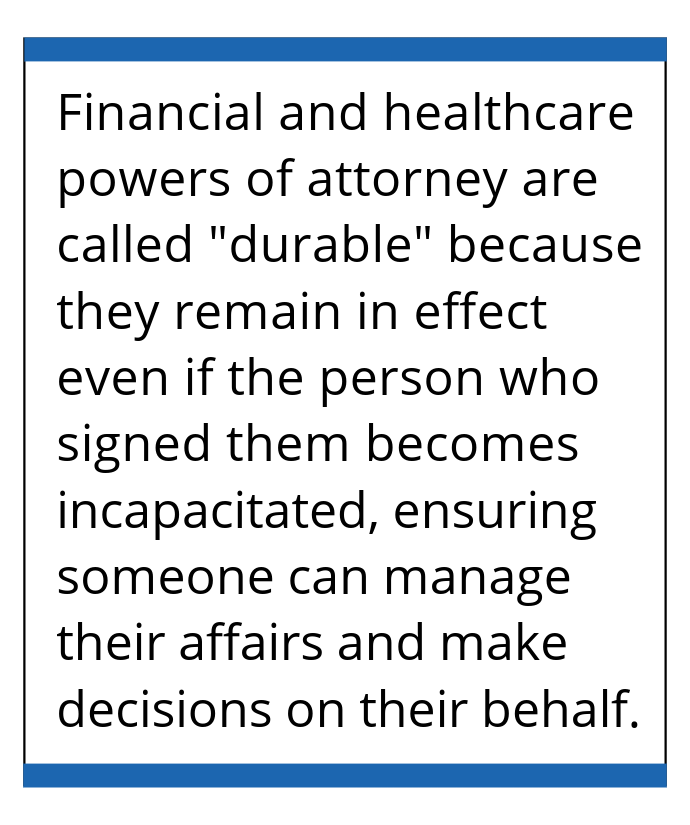

Financial Power of Attorney

Paying bills and managing finances are essential daily tasks—but what happens if you are unable to do so due to illness or disability? That is where a Financial Durable Power of Attorney can provide peace of mind.

If you are unable to make financial decisions, the financial power of attorney (POA) empowers another person or persons to make them for you. (Even if you are married, your spouse may not have the authority to act on your behalf.) The financial power of attorney ensures your chosen representative can take charge without delay.

Health Care Power of Attorney

In the event of a serious illness or accident, critical medical decisions may need to be made on your behalf. What happens if you cannot make these decisions yourself?

There are two key legal documents for health care planning:

- Durable Power of Attorney for Health Care – Authorizes a trusted person to make medical decisions for you.

- Living Will – Outlines your preferences for life-sustaining treatments.

Everyone, regardless of age, should have a Health Care Power of Attorney, as unexpected medical situations can arise at any time. Choose someone you trust, who understands your values, and can make decisions in your best interest.

Build Your All-Star Retirement Team

Retirement can span nearly a third of your life, requiring a different approach to financial decisions than in your working years. Once in retirement, you are relying on the savings and income you have built over time, making it crucial to have the proper guidance. An experienced financial advisor can help you navigate the unique challenges of retirement and assemble a team of trusted professionals to support your financial well-being. The advisors at Covenant Trust are ready to guide you through this stage, helping you create a personalized retirement strategy. As a corporate trustee and fiduciary, Covenant Trust is well-equipped to manage your retirement assets wisely and ensure your estate is settled efficiently when the time comes. Let us help you build your team and lead you toward a successful and stress-free retirement.