There are many elements of an estate plan. The most important items are a Will, powers of attorney for health care and property, and the creation of a Trust. This article will focus on the benefits of creating a Trust.

Trusts are flexible, varied, and complex. Many Trusts enable the Grantor(s), the person(s) creating the Trust, to do the following:

- Place conditions on how and when your assets are distributed after you die

- Potentially reduce estate and gift taxes

- Distribute assets to heirs efficiently without the cost, delay, and publicity of probate court

- Better protect your assets from creditors and lawsuits

- Name a successor trustee who will manage your Trust after you die or if you become disabled

What type of Trust should I consider?

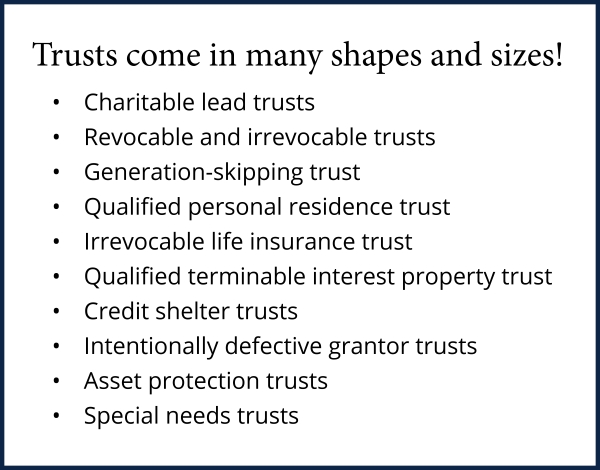

There are multiple types of Trusts, each with advantages and disadvantages, all of which should be discussed thoroughly with your estate-planning attorney before establishing.

Broadly speaking, there are three main options.

You can have an attorney draft a Simple Will. This is a legal document that spells out how you want your affairs handled and assets distributed after you die. If you only have a Will, assets must be distributed immediately. A Will allows you to:

- select an executor,

- nominate someone to have guardianship over your children,

- give charitable gifts at death, and

- provides instructions for the distribution of your assets and personal property.

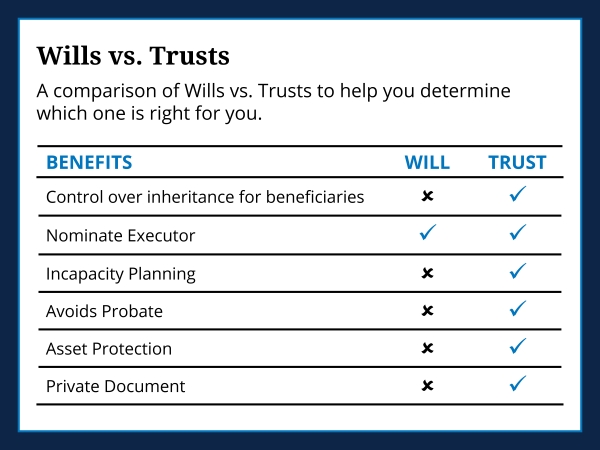

A Simple Will may be appropriate for some people with small estates and simple instructions. However, if you compare the benefits of a Will to those of a Trust, a Trust offers numerous benefits that will appeal to most people.

Many choose to create a Trust and pour-over Will instead of a Simple Will. A Trust is a fiduciary arrangement whereby a grantor (the creator) gives a trustee the right to hold and manage assets for the benefit of a specific purpose or person. Trusts can have a limited term, such as the duration of the grantor’s lifetime, or can be held for generations. If a Trust is created, it will be accompanied by a Pour-Will. This type of Will includes a “pour-over” provision that directs any holdings outside of the Trust to be “poured over” into the Trust and, therefore, catches any assets that were not titled in the Trust itself.

Finally, as the box on the right illustrates, it is important to note there are different types of Trusts for different situations. A qualified estate planning attorney can review your wishes and create the appropriate Trust.

Third, some individuals and families choose to create a testamentary Trust. A testamentary Trust or Trust Under Will is a device wherein the writer of a Will creates a Trust within the Will itself and decrees in the Will that certain property in their estate at the time of their death shall be distributed to said Trust and held for a specific purpose or duration. The disadvantage of a testamentary Trust is the assets will usually be subject to probate.

When is a Trust right for me?

Ultimately, the correct answer is that it depends. The best way to approach this topic is to look at all your assets and determine how you want these assets to pass on to your beneficiaries. If your estate is simple, you have beneficiaries already designated on all your assets, and you are certain that your estate will not end up in probate, then maybe a Trust is not right for you.

However, if you would like to control assets after death in any manner or will run into a state or federal estate tax issue, or have a charitable interest, or are afraid of your estate ending up in public probate court, then a Trust may be the right device to address these wishes.

One of the best reasons to create a Will or Trust is to avoid passing away “intestate” or without a Will. This will leave a burden on your family members or anyone close to you to properly transfer and dispose of your assets. This includes everything from personal belongings to a checking account.

The law requires that everything you leave behind is properly transferred and closed out. It is a big task when there is no plan in place to guide whoever must fill this position. Many states have already considered that many individuals do not have estate planning documents in place and have established small estate provisions that vary state by state.

In this situation, if you die intestate and your assets are under a certain threshold as determined by your state, you can use a small estate affidavit to settle someone’s estate and avoid probate. However, in this situation, if there is no Will then someone would have to volunteer, or your assets could become at the discretion of the state.

In any event, having a plan is always the right decision, and if your estate plan is something you keep saying that you will “get to,” it is time to sit down with an estate planning attorney and get a plan in place.