Welcome to Tax Season!

Covenant Trust is working hard to make tax season less stressful and give you the information you need to file quickly and accurately. Below you will find everything you need to know about when your Covenant Trust tax forms will be ready and what tax forms you may receive in the mail.

When Will Your Tax Forms Be Mailed?

Here’s a quick guide to mailing dates for common tax forms.

| Tax Form | Mailing Date |

|---|---|

| 1099-R | January 31 |

| 1099-DIV | Mid-February |

| 1099-INT | Mid-February |

| 1099-B | Mid-February |

| Grantor Tax Letter | Early March |

Pro Tip: We recommend that you wait until you have received all your tax forms before meeting with your tax preparer or filing your return. This ensures your return is accurate and up to date.

How will you receive your Covenant Trust Tax Forms?

Your tax forms will be mailed to you.

If you’re enrolled in eStatements, you’ll also have access to PDF copies of your tax forms in our Client Portal. Once your tax forms are ready, we’ll send you an email notification. After logging in, simply navigate to the Vault, select Statements, and then choose Tax Forms. From there, you can download your tax forms anytime at your convenience.

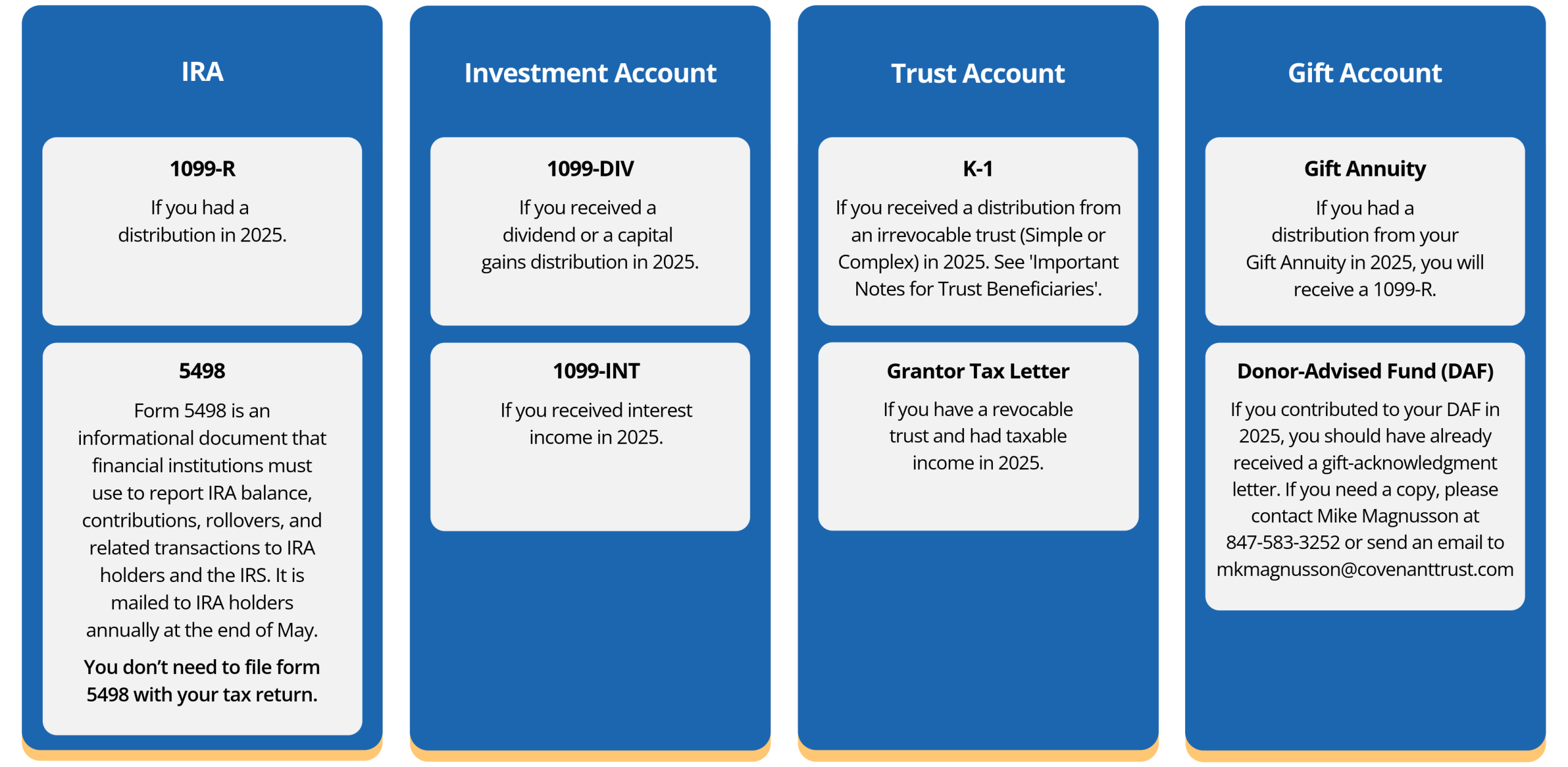

Which Tax Forms Should You Expect?

The tax forms you receive from Covenant Trust depend on the types of accounts you hold with us and your account activity throughout the year. Check the table below for a quick guide to which forms you may receive.

Important Notes for Trust Beneficiaries:

- If you received distributions from an irrevocable trust (Simple or Complex) in 2025, wait for Form K-1 before finalizing your tax return. Missing K-1 information may require you to amend your return later, so it’s best to hold off.

- Your Form K-1 may not be ready by the tax filing deadline. We partner with tax professionals to prepare K-1s and related tax forms. Delays in receiving trust accounting details and information may delay delivery until mid-March or later.

- If your Form K-1 is delayed, we recommend discussing your options with your tax preparer.

Have Questions? We’re here to help!

Check out the FAQ section or feel free to reach out to us with your questions.

- 847-583-3223, ask for the Tax Department

- taxinfo@covenanttrust.com

Helpful Tips for a Smooth Tax Season

- Know When Taxes Are Due

Taxes are due for most taxpayers on Wednesday, April 15, 2026. You can file early if you’re ready; the IRS will start accepting and processing your 2025 tax return in late January 2026. - Gather All Your Forms First

Having organized tax records helps you file complete and accurate tax returns and avoid errors that could delay refunds. Start by collecting:- Bank account information

- Forms W-2 from your employer(s)

- Forms 1099 from banks and financial institutions where you have accounts

- Records of digital asset transactions

- Double-Check Deadlines

Mark key dates on your calendar so you don’t miss important filing or payment deadlines. - Keep Digital Copies

Snap a picture or scan your tax forms and store them in a secure location for easy access and backup.

Frequently Asked Questions

A Grantor Tax Letter provides information to beneficiaries regarding their share of income earned by the trust. If you are a grantor of a trust, you would need A Grantor Tax Letter to report it on your Form 1040. You should share the information with your tax professional.

Yes. A Qualified Charitable Distribution (QCD) is made from an IRA distribution and results in the issuance of a 1099-R.

On your Form 1099-R, the amount of federal income tax withheld during the year is shown in Box 4, labeled ‘Federal income tax withheld.’ You will enter this amount on your tax return under federal income tax withheld.

A year-end combined 1099 form provides essential information about your investment activities, including details on interest, dividends, and distributions, as well as short- and long-term realized gains and losses, which can aid in tax return preparation.

Form 5498 is an informational document that financial institutions use to report IRA, HSA, and Coverdell ESA balances, contributions, rollovers, and related transactions to both the account holder and the IRS. Form 5498 is mailed out each year by the end of May. You don’t need to file Form 5498 with your tax return—it is for your records only.

A K-1 tax form is generated when a trust tax return is prepared.

Covenant Trust partners with experienced tax professionals to prepare these returns and related tax forms. Delays in receiving complete trust accounting details—such as year-end statements, reconciled transactions, or beneficiary updates—may postpone delivery until mid-March or later. When your K-1 is ready, we will mail it to you.

We recommend that you wait to receive your K-1 tax form before finalizing your tax return as missing K-1 information may require you to amend your return later. It’s also a good idea to discuss it with your tax preparer.

Beneficiaries who received distributions from an irrevocable trust (Simple or Complex) in 2025 will receive a K-1 tax form.

Form K-1 reports each beneficiary’s share of trust income, losses, and deductions. It’s typically available by mid-March, but delays in receiving complete trust accounting details may push delivery later. Once it is finalized, we will mail it to you.

For questions about your K-1 tax form, please contact our Tax Team at 847-583-3223 or send a detailed email to taxinfo@covenanttrust.com. You should also contact your tax preparer.

Tip: Protecting your privacy is important to us. Please do not include sensitive details—such as account numbers, usernames, or passwords—in any email correspondence.

For questions about your Covenant Trust tax forms please contact our Tax Team at 847-583-3223 or send a detailed email to taxinfo@covenanttrust.com. You should also contact your tax preparer.

Tip: Protecting your privacy is important to us. Please do not include sensitive details—such as account numbers, usernames, or passwords—in any email correspondence.