When working with clients, I often use the phrase, “personal finance is personal.” Everyone’s situation, including income, resources, goals, expenses, etc., is vastly different. Thankfully, we can use some great tools to estimate our needs, but it needs to be said that your situation is different from most everyone else’s.

Several years ago, a certain financial firm had a commercial wherein people walked around the city carrying a large number. The numbers that people were holding were in the hundreds of thousands of dollars, and some even into the millions. The commercial made the point that people have a number—an amount saved that is enough to retire. In this article, I will show you a few high-level ideas to consider when determining how much you need to save to have a successful retirement.

Before discussing how to get to this number, it is important for you to conjure up images of what you believe retirement looks like. What does retirement mean to you? Some people imagine traveling or spending time with loved ones. Others might start a business, volunteer more, or plan to provide care for someone. Some have a mix of all of these. The more you consider these images, the more your retirement goals will take shape.

Review your budget and retirement plans

A great place to begin is with your own personal budget. You can do this in one of two ways: if you track your expenses monthly, estimate what your expenses will be year-to-year. Another way is to calculate how much you save each month and assume that you are spending the rest monthly. Remove the expenses that will end with retirement, such as savings for retirement, expenses related to your job, and your mortgage or other debt that could be paid off by the time you retire. Some people downsize their housing situation when they retire, which could be another factor to include. The number you get will be your baseline spending in retirement.

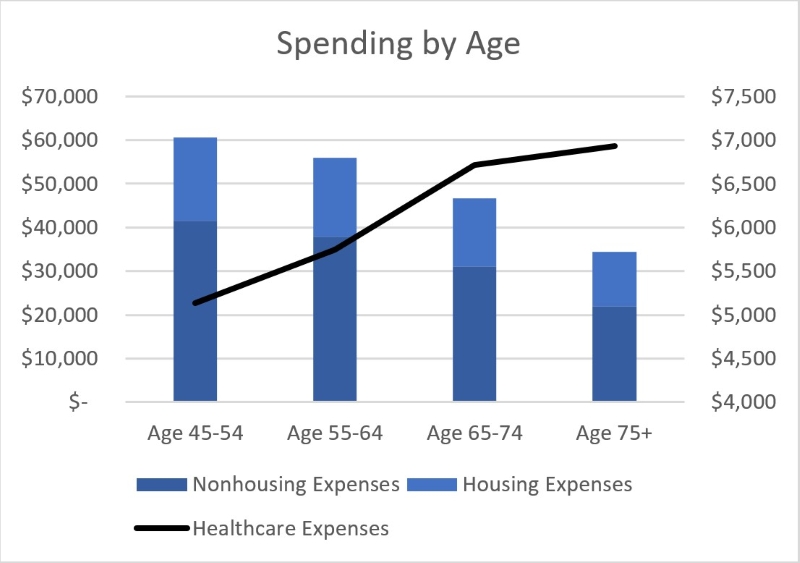

The reality for most people is that spending will look different at different stages of retirement. Some refer to the stages of retirement as the “go-go years,” the “slow-go years,” and the “no-go years.” Often, people like to travel, spend more on family, donate generously, etc., in the early “go-go years” of retirement. Depending on your goals, you may want to include the expense of travel or family needs in those early years. In the “slow-go years”, expenses tend to decrease as travel becomes less of a priority, and healthcare expenses often have not yet begun to be a large part of a retiree’s monthly budget.

As one nears end-of-life, sometimes healthcare expenses, including assisted living, live-in care, skilled nursing facilities, and multiple hospital stays, can put a strain on one’s financial situation. When I work with clients, we often do a stress test of their retirement plan to see if they can financially handle an extended time in skilled nursing or not.

Source: US Bureau of Labor Statistics

Identify your retirement income

Once you have a good idea of an annual budget for your retirement years, we can look at your sources of income. Social security is the base of income for most retirees. If you have not looked at your social security benefit lately, you can access it online at SSA.gov. Social security will help you cover your monthly expenses, but for many, it is not enough on its own. Some still have access to pensions through their employer and can begin receiving retirement benefits at a certain age, often for the rest of their lives.

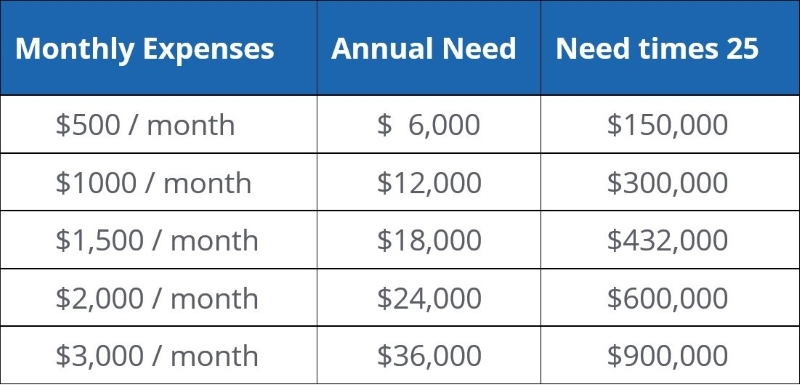

From here, we can use a rule of thumb to estimate how much one needs to save for retirement. You may have heard of this referred to as the “4% rule” or “safe withdrawal rate.” Many studies have shown that a diversified portfolio of stocks and bonds can sustain a withdrawal beginning at 4% over a 30-year period. How it works is you begin year one by withdrawing 4% of your retirement savings, then in year two, you adjust that amount by inflation.

To put it all together, you take your annual expenses in retirement and reduce those expenses by your sources of income (social security, pension, etc.). The result is the number you need to withdraw from savings, and using the 4% rule, you can estimate what you need to have saved. Another way to calculate the 4% rule is by taking the withdrawal amount and multiplying it by twenty-five. Let’s say you need $18,000 a year more than what Social Security provides to cover your expenses. $18,000 x 25 = $432,000. So, at your retirement age, you would need about $432,000 saved to safely withdraw $18,000 a year plus inflation over the course of 30 years.

The 4% Rule

How much you need saved for retirement.

Prepare the Best You Can

When I work with clients, the 4% rule is often a jumping-off point for more specific retirement projections. Everyone’s situation is different, and often, your income needs are the same year-to-year, or you may want to delay social security to increase your benefits from social security, or perhaps you are working part-time in early retirement. Here are some ideas if you find yourself behind on saving for retirement:

- Cut spending where possible.

- Increase your savings rate incrementally.

- Start a side hustle to generate additional income.

- Work longer and delay Social Security

- Work part-time in retirement

- Downsize your home or move to a more affordable area.

So, how much do you need to save for retirement? Your expected retirement expenses times twenty-five gets you a good idea of your retirement savings needs. If you’re interested in having a discussion with a financial professional about your retirement projections, contact Covenant Trust at info@covenanttrust.com, and we can get you in touch with your local Financial Services Representative who can help.