In the wild parts of eastern South Africa, lions rule the bush. They roam through rivers and ravines, grasslands, and thick brush as the monarchs of this ancient land. In this untamed land, lion trackers locate lion tracks on the ground and follow them wherever they lead. For generations, these trackers have been able to identify tracks, interpret subtle sounds and smells, and become attuned to the reactions of other animals when lions are nearby.

Beyond the surface, the habits and lessons of lion tracking offer deep insights into the complexities of our financial lives. Reflecting on a lifetime of lion tracking, Boyd Varty says, “In the bush and in life, we don’t get trails fully laid out. We get tremendous unknowns, if we are lucky, first tracks. Then next first tracks.” (Varty, Boyd. The Lion Tracker’s Guide to Life, Houghton Mifflin Harcourt, 2019)

Isn’t this true? Life is unpredictable, and trails change. The problem with traditional financial advice is that it views the future as predictable. It views our goals and desires as unchanging. But, of course, these things do change! We need a way of viewing our financial journeys as dynamic and alive.

Boyd’s mantra for lion tracking, “I don’t know where I’m going, but I know exactly how to get there,” offers a glimpse into a new way of thinking about our financial journey. We don’t know exactly where we are going – where we will live in 20 years, what our expenses will be, or even what our goals will be – but we do know how to get there. That is, we can put in place sound habits NOW that will serve us well LATER, whatever trails we find ourselves navigating.

As you begin 2024, consider cultivating these tracking skills for your financial journey.

🐾Find the First Tracks

The immediate goal of every lion tracker is to find the “first tracks.” That is, identify the footprint of the lion in the dirt, grass, or mud and then follow the prints. After the first track, you find the next one, and so on. Start small in your financial journey. Find the first tracks in your journey, such as spending less money than you earn. This is a crucial first track and the most fundamental skill in personal finances.

While this might sound simple, it requires intimate knowledge of your monthly income and expenses. In other words, it requires creating a (beware scare word ahead) “budget” to track your expenses (e.g., with apps or a spreadsheet) and then making incremental adjustments to ensure you are spending less than you earn. The idea of budgeting turns many people off. Budgets appear too time-consuming and guilt-inducing. Some are! But not all budgets are the same.

For those with little margin, mounting debt, or who are more detailed by nature, zero-based budgeting works well. This strategy requires you to designate 100% of your income for expenses, savings goals, and debt payments. Each month, your income minus your expenses should equal zero. Every dollar is allocated, making it impossible to spend more than you earn. If you overspend in one area of your budget, you must pull from another area to a total of zero.

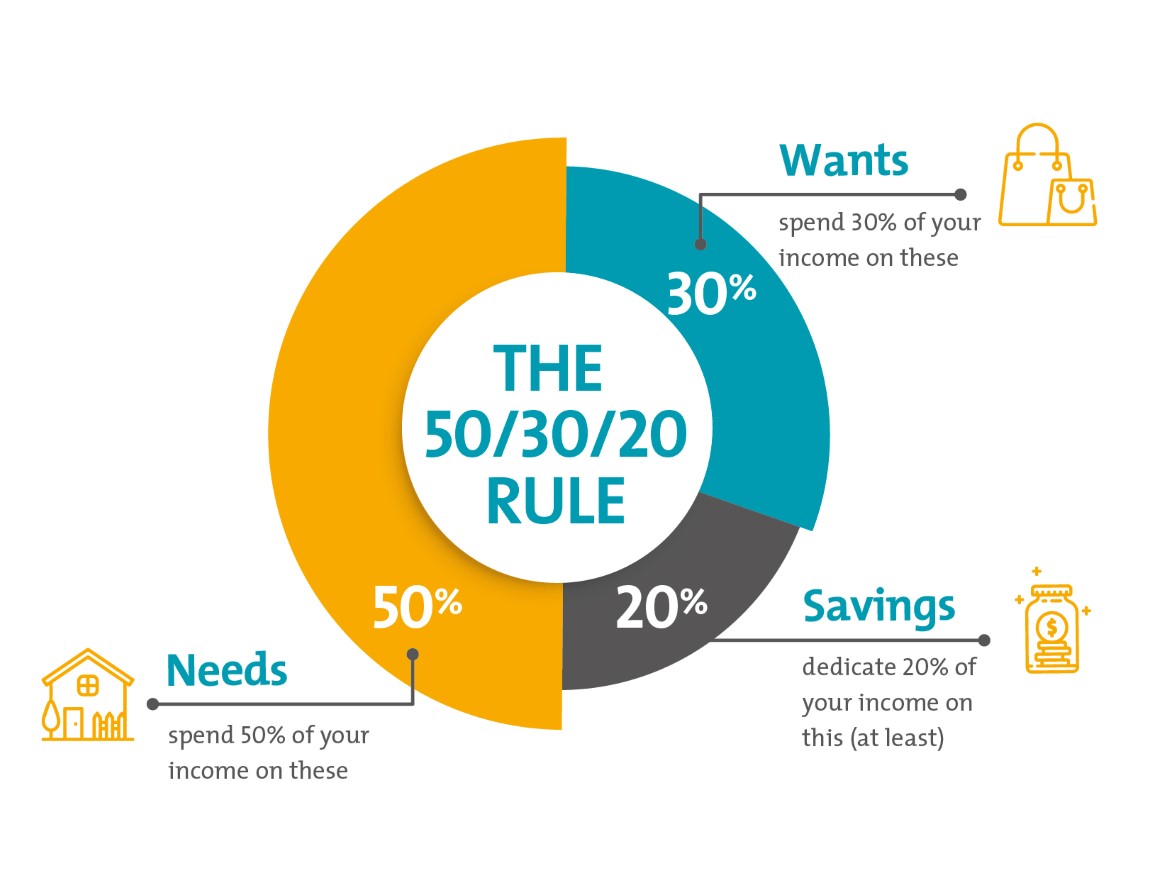

If the zero-based budget sounds too detailed, consider a simpler strategy that focuses on categories instead of individual expenses. The 50/30/20 budget lets you divide your income into three categories – spending 50% on needs, 30% on wants, and 20% on savings. This method helps reinforce savings and balance and tends to work well for middle-class earners and those who value simplicity. Whatever method you use, find your first tracks by spending less than you earn.

Source: Infinity Financial

😲Prepare for the Unexpected

Life, like the bush, is full of surprises. Preparation is key, whether in encountering predatory animals, poisonous plants, or unexpected medical bills. In our financial lives, this preparation requires us to create margin. According to Morgan Housel, “building wealth has little to do with your income or investment returns and lots to do with your savings rate.” (The Psychology of Money, p. 79) Everyone should vigorously work toward saving three to six months of expenses in an emergency fund. Ideally, this account is separate from your normal checking account and is in a high-yield savings account. These funds are available for things such as a sudden loss of income, emergency repairs, or medical bills.

To save aggressively, we must find ways to slash spending, save windfalls and bonuses, hunt for deals, and shop conscientiously. If you fall prey to impulse buys or “therapeutic shopping” consider waiting 72 hours before making large purchases. Small adjustments like this can make an enormous financial difference. The goal is to incrementally move out of a place of struggle (e.g., behind on bills) and into a place of stability (e.g., fully funded emergency fund) and, over time, to a place of security (i.e., having a surplus to save for short-term and long-term goals).

⚠️Cultivate Track Awareness

In the African wilderness, track awareness is how attuned you are to what is around you. Expert trackers have a sense of where they are in relation to other things. They must have this sixth sense of the time of day, movements of the earth, their current location, and weather patterns. Similarly, as we move through our financial journey, we want to have an awareness of where we are in relation to our goals and risks.

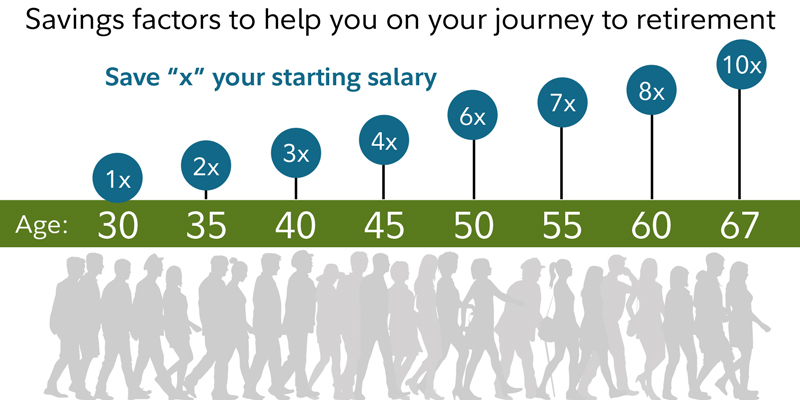

Source: Fidelity

Are you ahead or behind in your retirement savings? A general guideline suggests saving 15% of your income in retirement accounts, with adjustments based on factors like pensions or variations from the suggested savings amount (see chart). Awareness also extends to your debt-to-income ratio. To find your debt-to-income ratio add up all your monthly debt payments and divide them by your gross monthly income. Aim for a ratio below 36% to be able to qualify for loans and avoid overwhelming debt payments. In high-interest rate environments, prioritizing debt management becomes paramount.

🆘When You Lose the Tracks, Seek Help

Sometimes, lion trackers lose the lion’s tracks. The trail may run cold because water or other footprints may scuff up the tracks. Out of nowhere, the tracks vanish! Life works that way, too. One minute, you are following a clear set of tracks: the next, they vanish. Maybe you get laid off, divorced, a loved one passes, an investment tanks, or you fail at something important. In a moment, you can feel disoriented and lost. This is part of tracking, learning, and living. Accept the loss. Then go back to where your last clear track was. There is something to learn there, something to process.

In our financial lives, this is where we need the help of other trackers. In the ancient book of Proverbs, it says the wise person “plans ahead, seeks counsel, and surrounds themselves with many advisors.” (Proverbs 12:15, 13:16; 15:22). When there are things you don’t understand, when you need navigational assistance, find a financial professional and seek help. Work with a trusted advisor, such as your local Financial Services Representative at Covenant Trust, to create a dynamic plan to help you get on the trail once again. Study after study has shown that when investors track alone, when they depend upon a do-it-yourself strategy for investing and financial planning, big mistakes are made.

Our paths are ever-changing in the unpredictable financial wilderness, much like the untamed South African bush. Inspired by the wisdom of lion trackers, let’s apply their skills to our financial journey. We can do this by spending less than we earn, creating more savings, becoming aware of where we are on the path, and seeking help from trusted advisors.

Let’s get tracking!