There is no shortage of articles, seminars, conferences, and podcasts focusing on financial planning for retirement. Many people approaching their 60s start taking a more serious look at their finances, seeking assurance that funds will be adequate for their post-retirement years. Returning to the workforce, not out of choice but necessity, is a stressful concern. Financial planning is an integral part of preparing for a sound retirement, but there is another side to the retirement planning coin.

The Other Side of the Coin: Retirement Beyond the Numbers

Preparing for a productive and satisfying retirement is equally as important as the financial considerations. Exploring how one spends their time apart from work reveals values, commitments, sources of enjoyment, and a means of accomplishment not measured by dollar signs. The consideration of your life separate from formal employment can bring a loss of identity and sense of purpose.

However, retirement also ushers in a new season of opportunities and the flexibility to choose how and where time is spent. There is the freedom to take time off, relax, and travel, but many of us are hard-wired to be productive, responsible, and charged to redeem the time. Making every day count applies to all our years, not just a few. It is time well spent before the transition of retirement to identify hobbies, charities, church, or community needs that fit one’s interests, skills, and experiences. Putting some of this in place before retirement can ease the adjustments that accompany leaving decades of employment. A proactive planning approach helps reduce some of the uncertainty and possible anxiety regarding what life holds following retirement.

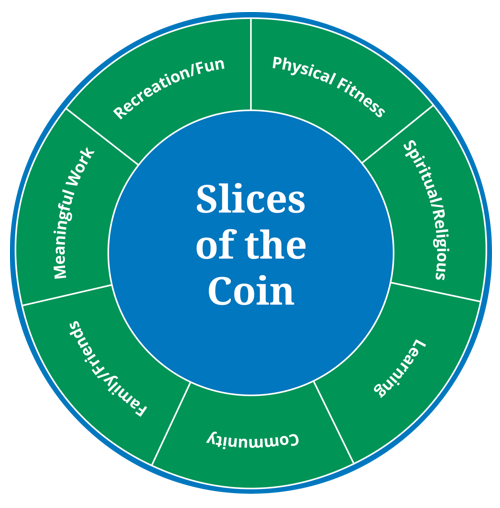

Slices of the Coin

Imagine the other side of the retirement coin split into slices. There are seven main slices, each representing an important area of life to attend to in retirement.

- Physical Fitness

- Spiritual/Religious

- Learning

- Community

- Family & Friends

- Meaningful Work

- Recreation/Fun

It’s not enough to have a sound financial plan. We also need to live with purpose and meaning. This means using our abilities to pursue opportunities beyond ourselves. It means exploring new hobbies and interests, investing in new friendships, cultivating our spiritual lives, and finding physical experiences to keep our bodies healthy.

The transition into retirement can be difficult. For many, these struggles include a sense of identity loss, social/relationship struggles, reduction in mental stimulation, mental struggle around not getting a paycheck, extra time to fill the day or anxiety/depression. These struggles are real. It takes time, sometimes years, to adjust to the new normal. As you adjust, consider how you can retire well in each area of life. If you are planning for retirement or in retirement, write out how you can proactively invest in each of these seven slices of the retirement coin. Or talk about them with your spouse or a close friend.

I don’t normally lean on Hollywood for life guidance, but there is an entertaining movie, “The Intern,” that offers a humorous perspective on retirement challenges. One of the main characters is a 70-year-old widower, bored with retirement. He takes an intern position at a women’s fashion business, where he forms an unusual friendship with a workaholic boss. It is fiction but could prompt thinking about what you see yourself doing 10 to 15 years from now.