Harry Potter once said, “When we don’t speak something, we make it more powerful.”

One of the things few people speak about is their money stories. Social scientists tell us everyone has a unique money story, primarily formed between the ages of 5 and 15. During these years, we absorb money messages from our caregivers, gender, generation, class, and religious upbringing.

These spoken and unspoken messages are sticky, lodge in our subconscious, and stay with us into adulthood. Our money stories are like this tape playing in our heads, impacting our spending habits, relationships, planning (or lack thereof), and emotional responses to money.

Let me give you an example.

Years ago, I lived in a 100-year-old shotgun-style house in Louisville, Kentucky. The house was charming but completely out-of-date. The flooring was peeling from the ground, and the lead paint (!) was chipping off the walls. Here’s what drove me mad — the homeowner, Ed, was wealthy. He had the financial ability to fix up the house but, for decades, never did.

This made no sense to me until I was talking to him in his woodworking shop one day. Ed, who was 91 years old, was still working part-time as a handyman. One afternoon, I walked into his dusty shop, where sawdust was hovering in the air like pixie dust. As Ed and I talked, he shared stories about the struggles of growing up on a farm in Eastern Kentucky during the Great Depression. He talked about wartime living and serving on a submarine in the Pacific during World War II. He recounted moving to San Francisco and starting a business after the War.

Aha!!

Suddenly, I understood. Ed had a different money story than me. He grew up during a time of scarcity, and I grew up during a time of plenty. We had radically different money stories, which explained why we thought so differently about spending money.

Learning about other people’s money stories helps us understand them. It helps us understand our spouses and friends, different cultures, classes, and people groups. But even more importantly, by investigating our money stories, we unlock the power of better understanding ourselves. We begin to make sense of our unspoken beliefs about money, thereby making money less powerful in our lives.

Reflect on your money beliefs. Do any of these resonate with you?

- Money is scarce. – “I didn’t have much growing up. I will preserve it now.”

- Money brings happiness. – “I feel good when I am spending!”

- Money is a source of anxiety. – “We had no money growing up. Not again!”

- Money is a topic to avoid. – “My parents never discussed money, and neither do I. It’s personal!”

- Money is a substitute for time. – “My father bought me things instead of spending time with me.”

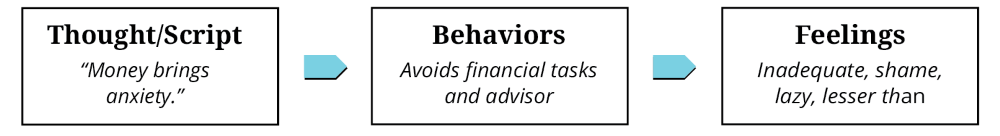

Each of these beliefs about money will lead to a different set of behaviors and feelings. I recall a woman, let’s call her Carol, for whom money was the source of anxiety. When she thought about money, she was flooded with memories of being eight years old and seeing her mother weeping at the kitchen table as she read an eviction notice. That was painful and led her into the following process:

Carol was not inadequate, lazy, or lesser than anyone else. Instead, she had a unique money story that was not of her choosing. Nonetheless, this story impacted her behaviors and feelings.

Once Carol understood where her behaviors and feelings came from, she could give herself grace and experience healing. Not only that, she could also move into a place where she could sift through her money story and decide which beliefs were empowering and which ones were limiting.

Money is a touchy subject. Like Carol, we’ve all made mistakes. We’ve all picked up unhealthy habits. There’s grace for that. And while we can’t change the past, we can understand it so we can do better in the future. As Tim Hedberg explains in his article Belief Driven Finances: How Your Beliefs Impact Your Finances, no matter your money story, you can write a better chapter in the future.

The first step, however, is to shine a light on your money story and where it came from because “when we don’t speak something, we make it more powerful.”

To help you better understand your unique money story, think through and write out your response to the following questions:

- Think of your family of origin and how money was handled. What do you remember? What did you feel?

- Were there role models that you looked up to? What did they teach you about money?

- What are 2 to 3 key life events that have helped frame how you handle money? (e.g., school, marriage, struggle, divorce, death, etc.)

- What are the gifts that have rippled from those life events?

- What are the challenges that have rippled from those life events?